We are proud to offer a range of accounts to help you make the most of your money.

A dedicated Savings Business Development Manager and Savings Support team.

We’re a building society, our profits go back into the business and community.

We are proud to offer a range of accounts to help you make the most of your money.

View our business savings rates below.

| Minimum Balance | £25,000 + |

| Interest Rate (AER1/Gross2) | 4.00% |

| Interest Payable | On maturity |

| Withdrawals | No withdrawals or early closures allowed |

| Access | Post or Branch |

| Minimum Balance | £1,000 + |

| Interest Rate (AER1/Gross2) | 4.25% (rate includes a 0.50% bonus for the first 6 months) |

| Interest Payable | Annually on 31 December |

| Withdrawals | Withdrawals, closure or transfers are subject to 180 days written notice |

| Access | Post or Branch, or exclusively online |

| Minimum Balance | £100,000 + |

| Interest Rate (AER1/Gross2) | 2.53% / 2.50% |

| Interest Payable | Interest payable monthly |

| Withdrawals | Unlimited withdrawals |

| Access | Post or Branch |

| Minimum Balance | £25,000 + |

| Interest Rate (AER1/Gross2) | 4.00% |

| Interest Payable | On maturity |

| Withdrawals | No withdrawals or early closures allowed |

| Access | Post or Branch |

| Minimum Balance | £1,000 + |

| Interest Rate (AER1/Gross2) | 3.00% |

| Interest Payable | Annually on 31 December |

| Withdrawals | 1 penalty free withdrawal per calendar quarter |

| Access | Post or Branch, or exclusively online |

For businesses looking to save, we are able to offer business savings accounts ideal for growing reserves or putting cash to work to help with periodic business expenses such as VAT, corporation tax or utility bill payments.

Not only do we put your money to work for you, by saving with us, your investment is going to an organisation that is directly responsible to its saving and borrowing members and dedicated to our local community.

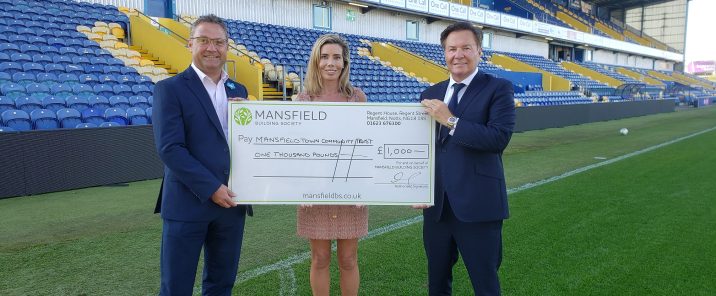

At Mansfield Building Society, we also share our commercial success through donations to local groups and charities via our Community Support Scheme and Charitable Trust.

We have a dedicated Savings Business Development Manager and Savings Support Team to help you through the application process and provide ongoing account support.

All of our business savings accounts can be viewed through our Mansfield Online portal.

1. Wide range of accounts

We are proud to offer a range of accounts to help you make the most of your money.

2. Dedicated local support

Our team of Nottinghamshire-based savings experts are on-hand to help.

3. Local commitment

As a local building society, we support local charities with donations and volunteering.

A business savings account is a savings account that is available to sole traders, limited companies or partnerships rather than to private individuals.

Because the accounts are available to organisations, rather than individuals, there are slightly different ways in which account opening and withdrawals are managed.

Business savings accounts work differently from personal savings accounts to help protect the organisations, their staff and customers from fraud. For example, not only will we need to see documentation confirming the business owner(s), we will also need to see proof that the people operating the account have the right permissions to do so. This is explained further in the product details and application form.

A business savings account is also separate from a business current account and businesses will need to have a business current account in order to open a business savings account with us as all withdrawals are sent to your business current account.

When a business applies for a savings account, we will require certain documentation to confirm that the people operating the account have the right permissions from the business to do so.

The documentation depends on the type of business and could include either a resolution from the Board of Directors or a signed mandate. We’ll also need to see proof of identity and proof of residency of the individuals operating the account and any other beneficial owners, for example, those with significant shareholdings. We will also need to see proof of the business current account you are nominating for withdrawals i.e. a copy of a recent bank statement.

We have a dedicated Savings Business Development Manager who can help you through the entire process. If you would like to talk to someone about our business savings accounts please email business@mansfieldbs.co.uk.

Subject to product terms and availability, we can accommodate a maximum deposit of up to £1 million per account.

All of our business savings accounts can be viewed through our Mansfield Online portal.

We can accept online transactions on savings accounts where the account is set up and operated exclusively online. However, businesses wanting to operate an account exclusively online have to accept that we will only recognise a single account signatory i.e. we cannot accommodate two signatories online.

For businesses requiring a minimum of two signatories, withdrawal requests will be by post or branch, with the funds withdrawn by electronic transfer or cheque payable to the business bank account.

Business savings accounts can offer a more stable return on investment compared to stocks and shares because the capital is not at risk to fluctuations in the stock market.

In a business savings account, up to £85,000 is covered by the Financial Services Compensation Scheme (FSCS) provided you meet the FSCS eligibility. You can find out more here https://www.fscs.org.uk/making-a-claim/claims-process/small-business/.

Business savings accounts can also offer a range of access options to suit your business needs – these often provide more interest if you’re happy to tie your money up for longer. Whether it’s notice accounts or fixed term bonds, meaning you can plan your investments to meet your businesses financial needs.

Opening a business savings account can be a little more complicated than for a personal savings account because we have to do checks on the business as well as the individuals that own or run the business. Businesses have to provide appropriate documentation and this can take a little time to get together. If there is a change of personnel or ownership of the business it can also be a little more complicated to make the changes than it would for a personal savings customer.

If your business requires two or more signatories to make a withdrawal, you will need to operate the account in branch or by post as our online system will only recognise a single account signatory. If you operate the account online you will need to make sure that you have appropriate controls in your business to manage/mitigate any potential risks as our system will only accept a single account administrator.

The Financial Services Compensation Scheme (FSCS) only covers up to £85,000 of your savings, provided you meet the FSCS eligibility. Should you want to save more than this amount, the excess could be at risk if the financial provider fails. You can find out more here https://www.fscs.org.uk/making-a-claim/claims-process/small-business/.

AER stands for Annual Equivalent Rate and illustrates what the interest rate would be if interest was paid and compounded once each year. AERs on the Monthly Income account assume interest is added to the account each month although in practice the option to have interest added in this way is not available.

The gross rate is the contractual rate of interest payable without tax taken off.

If separate AER/Gross rates are not quoted, both rates are identical.

Tax free means exempt from UK income and capital gains tax in the hands of the investor.

Want to ask us a specific question? Enquire online here or phone us on 01623 676350

Our intermediaries website is for use by authorised intermediaries only.

Please click on the link below to proceed

Continue to intermediaries site